The first quarter is a great time to reflect on the importance of tuning out those financial industry experts who make confident-sounding predictions about exactly what will happen in the coming year. All that’s needed to remind us of their folly is an introspective examination of how those predictions panned out last year.

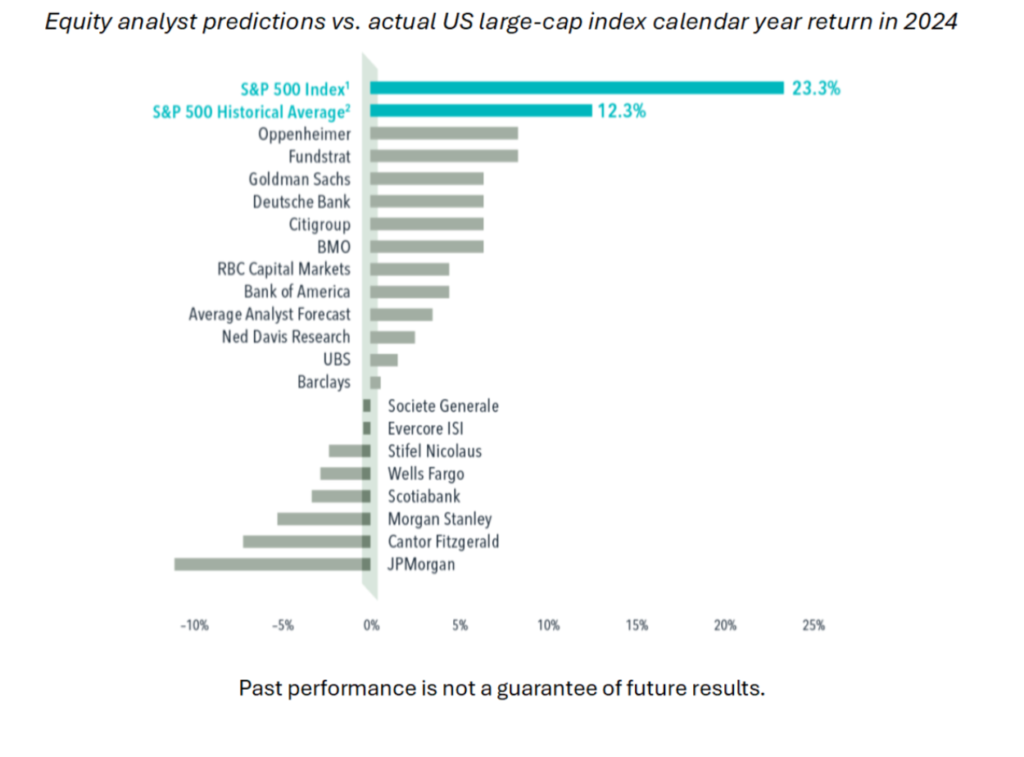

For reference, US large-cap stocks rose by 23.3% in 2024. This figure far exceeded the expectations of analysts polled at the beginning of the year, none of whom believed that the US large-cap market would grow by even its historical average rate of return. In fact, nearly half of the analysts predicted a negative year for the index. For their sake, we hope those industry-famous analysts didn’t miss out on returns from US stocks during such a strong year.

The wide dispersion and wanton inaccuracy of predictions from the supposedly smartest and best-resourced analysts in the country highlight exactly why we at Rockwood do not make asset allocation decisions based on forecasts. Prognostication-based strategies have no place in a disciplined and evidence-based investment process. In order to earn the long-term average returns to which you are entitled, we know that you need to be “in your seat” when the market delivers bursts of exceptional returns.

John, a New Hope, Pennsylvania native, is the Founder and CEO of Rockwood Wealth Management. A former nuclear engineer, he is committed to the development and growth of conflict-free comprehensive financial planning and investment management. John values a client-centric practice and unwavering integrity in all of our endeavors as stewards of our clients' best interests.