The 60/40 portfolio had a hard time offering much support.

With both fixed income and equities declining on the year, the traditional 60% stock/40% bond portfolio had a hard time offering much support in either asset category, leading some to question the utility of this approach. Although 2022 was the worst year in history for many bond indices, the performance of the 60/40[13] portfolio didn’t crack the top five peak-to-trough drawdowns in close to a century’s worth of data. The drawdown that reached 19% at its nadir was painful, but it’s only two-thirds of the 30% peak-to-trough drawdown investors[14] endured through a particularly difficult period from 2007–2009.

And the portfolio saw some recovery late in the year, ending down 14% for 2022.

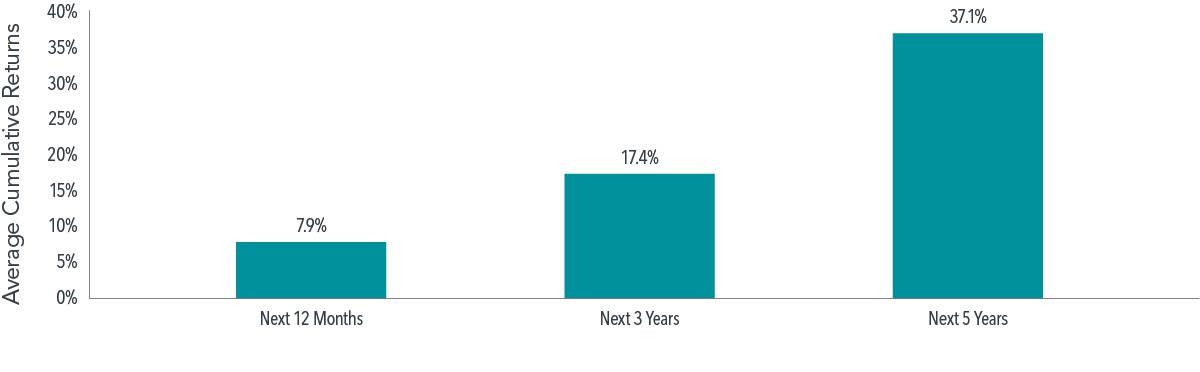

During rocky markets, it is especially important for investors to focus not solely on where returns have been but also on where they could be going. Looking at the performance of a 60/40 portfolio following a decline of 10% or more since 1926, returns on average have been strong in the subsequent one-, three-, and five-year periods (see Exhibit below).

Exhibit A Case for Optimism In USD. Drawdowns include all periods where the 60/40 portfolio declined by 10% or more from the prior peak. Peaks are defined as months where the 60/40 portfolio’s cumulative return exceeds all prior monthly observations. Returns are calculated for the one-, three-, and five-year look-ahead periods beginning the month after the 10% decline threshold is exceeded. The bar chart shows the average cumulative returns for the one-, three-, and five-year periods post-decline. There are 10, nine, and nine observations for the one-, three-, and five-year look-ahead periods, respectively. Source: Morningstar Direct as of December 31, 2022. Five-year US Treasury notes data provided by Morningstar. S&P data ©

2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio

13. The 60/40 portfolio consists of the S&P 500 Index (60%) and five-year US Treasury notes (40%). Five-year US Treasury notes data provided by Morningstar. S&P data © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. 14. Peak-to-trough drawdowns include all periods where the 60/40 portfolio declined by 10% or more from the prior peak. Peaks are defined as months where the 60/40 portfolio’s cumulative return exceeds all prior monthly observations. Troughs are defined as the months where the 60/40 portfolio’s cumulative return losses from the prior peak are the largest.

John, a New Hope, Pennsylvania native, is the Founder and CEO of Rockwood Wealth Management. A former nuclear engineer, he is committed to the development and growth of conflict-free comprehensive financial planning and investment management. John values a client-centric practice and unwavering integrity in all of our endeavors as stewards of our clients' best interests.