Why Market Corrections Do Not Faze Well-advised Investors

As dogged advocates for our clients’ long-term positive investment outcomes, we often use our quarterly perspective to contextualize recent macro-level events such as the geopolitical conflict in Ukraine. While the human tragedy in Ukraine is categorically heartbreaking, the portfolio implications are likely to be quite pedestrian.

For reference, through January, U.S. stocks were down a little more than 10% from the end of 2021.

If not for a strong session on Friday, January 28, U.S. stocks would have had a fourth consecutive week of negative returns. Like rough waters at sea, choppy markets can lead to anxiety and discomfort, and inevitably everyone wonders how long we will have to wait for things to calm down.

When volatility increases, it is perfectly natural to worry about how fast – or how far – markets may fall and, beyond that, how long it might take for stocks to recover and get back to normal times.

But what exactly are normal times? In this article, we provide some statistics on other stock market pullbacks over the past 90+ years. While by no means a crystal ball, this context may provide a dose of Dramamine to anyone wishing for calmer waters.

What Constitutes a Market Dip?

You have likely read about various return thresholds with accompanying labels. A return of -5% from a previous high is technically a “pullback,” -10% is “correction” territory and -20% is a “bear market.” Let’s examine the U.S. market data since 1926.

Figure 1 | Market Declines Are Normal

In Figure 1, we show the number of times the market has fallen at least 2.5%, 5%, 10% and 20% from previous peaks, along with the median length of time before it recovered (got back to its previous high).

For example, from July 1926 through the end of 2021, the market declined at least 10% from its previous high 29 times, or a little more often than once every four years. The median drop among this sample was -20.1%, and the median length of time it took for the market to return to its previous high was 194 trading days. Drops of at least 5% occurred 90 times, or a little less frequently than once per year over the sample period. When looking at this data, the main observation is that declines happen fairly frequently, and in many cases, markets have recovered reasonably quickly. Significant declines are not extremely rare events. Normal times include market declines and periods of higher anxiety.

A Closer Look at Market Corrections

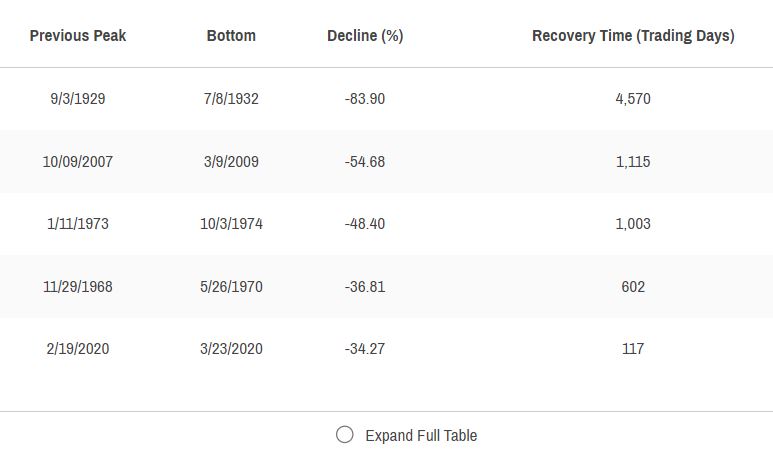

Sometimes averages and even medians don’t give us the full picture. It may be that no two market downturns are alike. We took a closer look at the 29 declines of at least 10% since 1926 and ranked them by the severity of the decline in Figure 2.

What stands out? First, the difference in magnitude among the declines is considerable. More than 20% of the declines in this category fall between -10% and -11%, and just about half of them fall between -10% and -20%. There is also significant dispersion in the length of the drawdowns and recoveries.

The bear market from early 2020 is likely still fresh in everyone’s mind. Markets fell quickly between late February and late March as investors worried about the impact of COVID-19, but the markets also rallied quickly, making up all lost ground in just 117 trading days.

Throughout history, there have been even faster recoveries and many slower ones. While it is easy to identify and plot in hindsight, attempting to predict when markets will “peak” or “bottom” is unlikely to be a fruitful endeavor.

Figure 2 | A Closer Look at 29 Declines of at Least 10% Since 1926

Considering market drawdowns as part of normal times, something expected to happen from time to time, allows advisors to create portfolios that may withstand these events and prepare their clients to deal with the anxiety they cause.

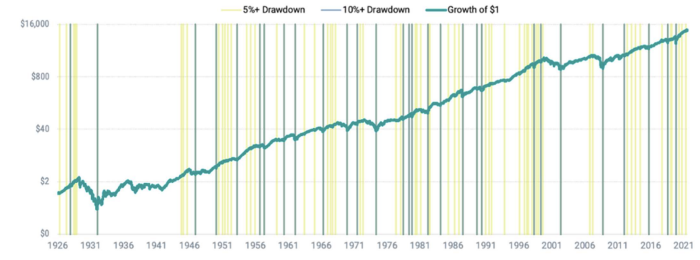

Luckily, long-term investors may be able to view these events through an alternate lens. Figure 3 plots the cumulative growth of $1 invested in the U.S. stock market from 1926 to 2021. The vertical lines in the chart depict the market bottoms associated with pullbacks (5%) and corrections (10%).

While it is doubtful any of those pullbacks and corrections were pleasant when they happened, investors who stayed the course and remained invested were likely better off for having done so. A dollar invested in July 1926 would have grown to more than $11,614 by the end of 2021!

We can also look at recent history to provide additional context if the period in Figure 3 seems too abstract.

The CRSP U.S. Total Market Index returned 16.3% per year over the past 10 years, a period in which there were 14 drawdowns of at least 5% (four of those were drawdowns greater than 10%).

The bottom line? Downturns and volatility are part of investing, just as winds and waves are part of being at sea. As investors, we can’t control markets, but we can control how we set up our portfolios and how we react. As much as ever before, we believe preparing for the waves and riding out these storms is still the best course of action.

Figure 3 | Growth of $1 Since 1926, Including All Corrections

Glossary:

CRSP U.S. Total Market Index. Consists of nearly 4,000 constituents across mega, large, small and micro capitalizations, representing nearly 100% of the U.S. investable equity market. The Russell 3000®

Index declined 10.04% year-to-date through January 27, 2022. Source: FactSet. Figure 1 and Figure 3: Data from July 1926 to December 2021. The market is represented by the CRSP U.S. Total Market Index. Note: Each decline bucket includes the more severe drops. For example, all fifteen 20% declines are included in the other three buckets.