Looking to the Past as a Guide

It was an up-and-down year for markets—in the end, one with more down than up. The world gave financial markets a lot to process. The coronavirus pandemic eased but remained a global concern, as did the supply-chain issues that accompanied its arrival. Inflation reached a 40-year high in the US[1] and the Federal Reserve pursued a series of interest rate increases to combat rising prices, actions similar to those taken by other nations’ central banks. Russia’s invasion of Ukraine in February brought uncertainty about political stability and energy prices, among other worries. A midterm US election shifted more power to Republicans but left Democrats in a stronger position than some had expected. Against this backdrop, equity and bond markets fell for the year, despite several rallies.

Inflation was front and center all year long. The US experienced the highest price increases in four decades, and the Fed lifted rates in a bid to reduce inflation from above 9% to the long-term target of 2%. Price increases showed signs of peaking late in the year, with inflation easing to 7.1% in the US in November, although a slow retreat from multidecade highs could keep it a concern for central banks well into 2023. Supply-chain issues related to the pandemic and to Russia’s war in Ukraine also eased, and food and fuel costs declined.

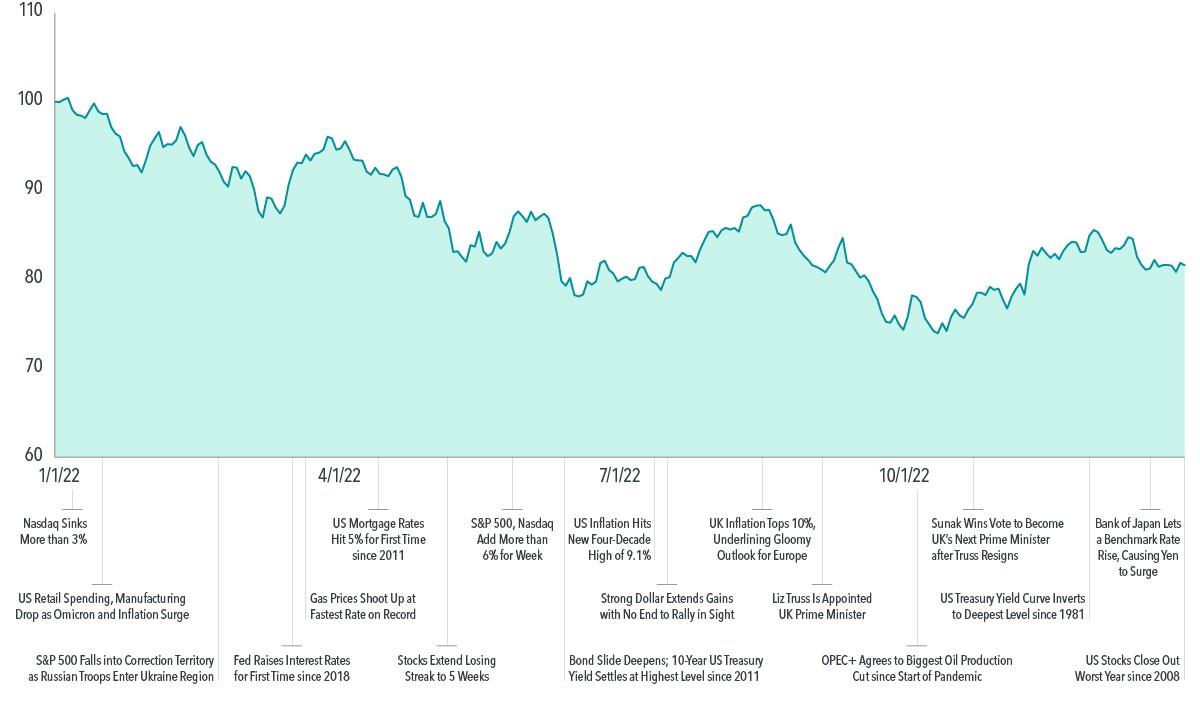

Exhibit 1 Late Rebound Not Enough for Markets In USD. MSCI All Country World Index, net dividends. MSCI data © MSCI 2023, all rights reserved. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Headlines are sourced from various publicly available news outlets and are provided for context, not to explain the market’s behavior.

The midterm elections in the US left a split Congress, with Democrats narrowly controlling the Senate and Republicans taking back the House, which could affect the legislative agenda and items like tax increases and spending packages. But investors may be wise to avoid focusing much on the outcome of elections, as markets have tended to reward those who stayed invested regardless of the outcome. And elections are just one of many factors influencing returns.

The S&P 500 Index[2] fell to a two-year low in September; at one point, the index had given back 50% of its post-pandemic rally. After the sharp drop in the first half of the year, led by technology stocks, the stock market rebounded somewhat. That came as the political situation became clearer and with investors pricing in prospects of smaller Fed rate hikes going forward as inflation cooled. Despite the rally, the S&P 500 fell 18.1% for the year, its worst annual return since the financial crisis in 2008. Likewise, global stock markets ended with their largest declines since the financial crisis. Global equities, as measured by the MSCI All Country World Index,[3] fell 18.4% (see Exhibit 1). Developed international stocks, as represented by the MSCI World ex USA Index, lost 14.3%, while emerging markets declined even further, with the MSCI Emerging Markets Index down 20.1%.

While markets were down as a whole, value stocks were a bright spot for investors. Value shares have prices that are low relative to a measure like a company’s book value, and these stocks outperformed pricier growth stocks by the largest margin since 2000, at the end of the initial dot-com craze: The MSCI All Country World Value Index fell 7.5% vs. a 28.6% decline for the MSCI All Country World Growth Index. That recent turnaround has rewarded investors who remained disciplined following a three-year slump for value, which ended in June 2020. Since then, value has beaten growth by 10.1 percentage points, annualized. Small capitalization stocks held their own with large cap stocks. The MSCI All Country World Small Cap Index declined 18.7% vs. the 18.4% fall for the MSCI All Country World Index. Historically, small cap stocks have outperformed large cap stocks.[4]

1. Inflation data as defined by the Consumer Price Index (CPI) from the US Bureau of Labor Statistics.

2. S&P data © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

3. MSCI data © MSCI 2023, all rights reserved.

4. The MSCI All Country World Small Cap Index has outperformed the MSCI All Country World Index by 2.7 percentage points, annualized, since 1999, the first year for which data is available.

John, a New Hope, Pennsylvania native, is the Founder and CEO of Rockwood Wealth Management. A former nuclear engineer, he is committed to the development and growth of conflict-free comprehensive financial planning and investment management. John values a client-centric practice and unwavering integrity in all of our endeavors as stewards of our clients' best interests.