Appropriate insurance coverage is one of the building blocks of a comprehensive financial plan, but the rising costs of premiums in recent years have been a point of frustration for many. Let’s revisit the role of insurance planning, unpack the reasons for rising premiums, and cover some sensible planning techniques that can potentially reduce premiums without putting your financial plan at risk.

Why is insurance a critical component of a financial plan?

At its core, insurance is a method of transferring the risk of financial loss to an insurance company. While the exact types of insurance needed will vary based on a client’s unique situation, we look to insurance to solve three specific needs:

- Protecting assets: Think of your home, your car, or your business. Property and casualty insurance can protect you from damage or loss due to unforeseen events. Without insurance, you would have to dip into, or potentially deplete, your savings to cover the cost of repairing or replacing a damaged asset—an outcome that could have a significant impact on your long-term plan.

- Managing liability: Liability insurance can also provide protection against legal liabilities, such as personal injury claims or other lawsuits.

- Ensuring income continuity: Many financial plans rely on continued cash flow to achieve their stated goals. Life and disability insurance can replace income if you or a loved one is no longer here to earn an income or is unable to work due to illness or injury. These coverages can help meet financial obligations, such as mortgage payments or daily living expenses on an ongoing basis.

If you feel like your insurance premiums continue to rise, you’re not alone. Property and casualty insurance rates in the United States have now risen for 20 consecutive quarters. Undoubtedly, there are several factors contributing to this ongoing trend. While the list below is certainly not all-encompassing, it highlights some of the reasons for these increased costs:

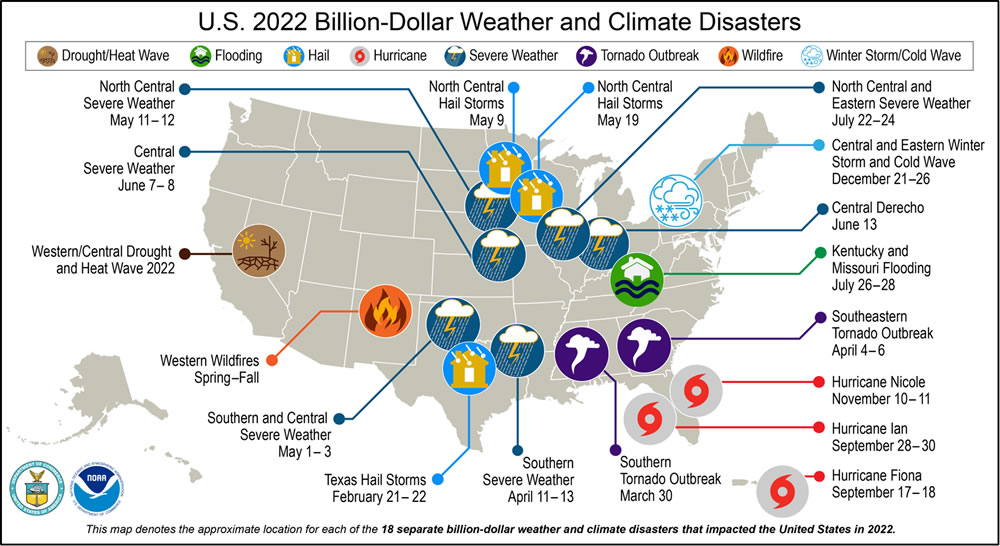

- The frequency and severity of natural disasters: In 2022, the United States saw 18 different natural disasters that each caused at least $1 billion in damages. Adjusted for inflation, the cost of the damage caused by these disasters was the third highest since 1980. In the past five years, the overall cost was approximately $600 billion—or roughly $120 billion per year.

- Rising cost of medical care: As medical costs continue to increase, the costs associated with personal injury resulting from a car accident will also rise.

- Higher labor costs: Auto repair shops, contractors, and insurance carriers have all experienced increased labor costs as the economy has been experiencing inflation.

- Incorporation of advanced technologies: In recent years, automobile manufacturers have continued to incorporate advanced technologies, such as sensors and cameras, into cars to increase safety and reduce the frequency of accidents. While this is certainly a noble pursuit, these technologies have led to increased specialization in automobile repairs (see higher labor costs). Unfortunately, the frequency of accidents has continued to rise, also contributing to rising costs.

- Broader inflation: In the case of home insurance, the cost of building materials has increased dramatically, making repairs, and rebuilding after damage far more expensive.

How can we maintain adequate protection while managing rising costs?

- We watch pricing: The first step in controlling your insurance premiums is knowing pricing trends across a wide selection of quality companies. Insurers offer different rates on different types of coverage, so we need to price policies from time to time based on known pricing trends.

- We’re strategic with your deductible: The deductible is the amount you pay out of pocket before your insurance kicks in. We generally favor larger deductibles and less frequent claims. A way to think about your current deductible is to ask yourself, “Would I submit a claim at this dollar amount?” If the answer is “No, I’d probably just pay for it,” then we’ll increase that deductible and save money on the policy. But beware: If the policy is covering an asset that has an associated loan, the deductible amount might be mandated at a certain level.

- We do not automatically bundle: Some carriers offer discounts if you bundle your policies. While bundling can save, we are also seeing opportunities where policies from different carriers can reduce overall premiums. Remember tip #1.

- We help you drive safely: Wait, we don’t actually help with that! But you already know that maintaining a clean driving record is among the best ways to keep your car insurance premium low. Life is about the journey, not about how quickly you get to the destination.

- We pay attention to discounts: The features of your assets can impact pricing. Cars that are safer and less likely to be stolen or involved in accidents can have lower insurance premiums. Certain carriers will incentivize homeowners to make upgrades to their home, such as installing water shutoff valves or upgrading a security system, by providing policy discounts. Have an art or wine collection? How do you store those valuables? This can impact pricing. We have seen it all and can review with you.

- We make sure you maintain good credit: This is an often-overlooked factor in pricing. Insurance companies can use credit scores to determine rates. While we help you stay financially robust, if your credit score is lower than you would like, we can explore ways to navigate around this issue, such as using your spouse’s credit or taking steps to raise your score.

- We continually review your coverage: We want to make sure you are only paying for the coverage that is appropriate for your plan. For example, if you have an older car, you may not need comprehensive coverage, which covers non-collision damage to your vehicle. While we don’t want to under-insure any asset within your plan, we don’t want to over-insure it either.

How about some good news?!?

The good news is that your advisory team at Rockwood is aware of the changes in the property and casualty insurance market. We regularly interface with trusted insurance advisors and will be ready to review your insurance coverage with you at your next Progress Meeting. Our aim is to find the right balance of protection and price that is appropriate for your plan. As always, our only responsibility is to you.

John, a New Hope, Pennsylvania native, is the Founder and CEO of Rockwood Wealth Management. A former nuclear engineer, he is committed to the development and growth of conflict-free comprehensive financial planning and investment management. John values a client-centric practice and unwavering integrity in all of our endeavors as stewards of our clients' best interests.