Why I’ll Always Be Optimistic about the Market

Written in late 2021, David Booth (Executive Chairman and Founder of Dimensional Fund Advisors) lends his perspective on what has happened in the market since COVID‐19 began and shares his views going forward.

It’s hard to believe we’re approaching the end of the second year of this global pandemic. Despite the pain and loss endured by so many all over the world, I hope some positive changes have come from the shock we’ve all been forced to experience. As we look forward to 2022, despite continued uncertainty, I’m feeling a sense of educated optimism that’s stronger than ever before. Why? Because over the past two years, my beliefs have been tested more than ever. And they’ve held up.

At the start of 2020, before we knew the extent of the global pandemic we were headed toward, I reminded investors that the market has no memory and encouraged them to avoid making forecasts and timing markets based on predictions of the future.

A few months later, I thought human ingenuity would lead our way through the crisis. It has. I didn’t know when a vaccine would be available or who would make it, but I never doubted the power of so many great minds focusing on one huge problem.

When we were in the midst of March 2020 and the S&P 500 was down 20%, it was scary. I wrote then that we can’t control crises, but we can control our response to them. Those who could stay in the market were rewarded. Over the next 12 months, the S&P went up 56%.

So now we find ourselves at the doorstep of 2022, and we’ve just seen the S&P 500 hit record highs—again. But not all investors perceive this as good news. Record highs make many people nervous, because they think that what goes up must come down. When markets are working as they should, reaching record highs with some frequency is exactly the outcome we would expect. That makes intuitive sense, because if stocks didn’t have a positive expected return, no one would invest in them.

This brings me to why I’m always optimistic about the power of markets, and why I always bet with them rather than against them: Markets represent people coming together. We can’t predict the nature or timing of a crisis, but we can bank on human ingenuity finding a path through it. Markets are forward‐looking and reflect this optimism—an optimism that I believe is innate to humanity. And your optimism only increases when you begin to understand how markets work.

“Rather than having to guess what will happen to whom and when, I choose a different path. I invest in the market.”

How we deal with uncertainty is the central challenge of human existence. We are defined by the choices we make, but we never have all the information we want. So, what do we do?

It pays to have a philosophy to guide our choices, in investing and in life. In conversations with investors over the years, I’ve explained my philosophy about markets in different ways, but what all these descriptions have in common is the choice to side with human ingenuity rather than against it. Betting against the market is exhausting, and we believe that it doesn’t pay.

So, at the end of every year, we look back and forward. What do we think this year will bring? I don’t know. No one does. Think about it: No one does. After these past two years, this lesson should be obvious to all of us. But for the past 50 years, I have held a long‐term faith in the power of markets. When they go up or down, I see them simply responding to new information. The market always wants buyers and sellers to make a deal. Transactions only happen if people agree on a price that seems fair to both sides.

In 2022, new challenges await. New businesses will grow. Old ones will adapt. Some will fail, while others will flourish. Rather than having to guess what will happen to whom and when, I choose a different path. I invest in the market. It is a unique human invention. From it flows our modern life. Most of us live in a world where we go to the store or pick up our phones and see choices I could not have imagined as a boy. So, of course, I am optimistic. And, of course, there is more work to be done. The problems we face as humans are daunting. That has always been true. I was born at the end of World War II and before a vaccine for polio. I wake up every morning believing the market will go up a little, but I also prepare for it to drop. And you should too. Markets will go up and down, but you should expect them to be positive, and that is what history has also shown. If you can hold this in your heart, you can be optimistic and resilient, you can manage the central challenge of human existence.

It’s hard to do. But it’s worth it.

Rising Government Debt: How Does It Impact Stocks?

From Wes Crill (PhD, Head of Investment Strategists) and Bryan Ting (PhD, Researcher) at Dimensional Fund Advisors.

As of the end of 2020, the US debt held by the public amounted to $22 trillion, an increase of approximately $5 trillion from the year before and well over double the level a decade ago.

This trend may be worrisome for investors expecting an adverse impact on stock returns once the bill for all this spending comes due. However, the relation between country debt and stock markets is complex, in part because sovereign solvency is dependent upon many factors other than just debt level.

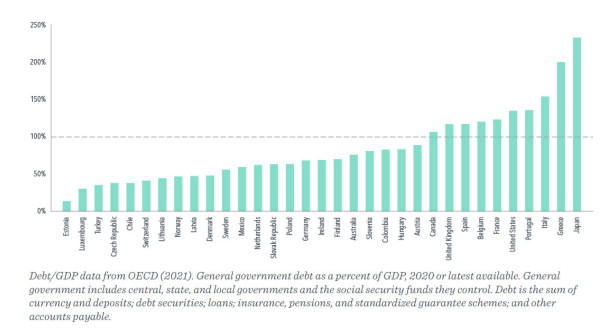

In addition, debt is generally a slow‐moving variable whose expected value should be incorporated into market prices. Consistent with this belief, the evidence suggests there has not been a strong relation between country debt and equity market returns. The US has hardly been alone in its recent escalation of debt. The bar graph featured on the following page shows that roughly half the Organization of Economic Co‐operation and Development (OECD) member countries have general government debt‐to‐gross domestic product (debt/GDP) ratios above 70%, with 10 countries—including the US, Japan, and the United Kingdom exceeding 100%.

The intent behind much of this recent government spending was to mitigate the economic impact of the COVID‐19 pandemic. But while governments pending may provide a short‐ term stimulatory effect on the economy, the prospect of higher future taxes and long‐run impacts on spending and investment introduces many channels through which spending and debt levels might affect expected stock returns.

These theoretical arguments can be distilled down to impacts felt through company cash flows—in the case of the higher borrowing cost or lower private spending arguments—or through discount rate effects, such as that of the consumption volatility story. An important point for investors is the uncertainty regarding which component should dominate and the time horizon over which these effects appear.

Moreover, economic theory does not offer a debt threshold beyond which a country is in economic peril. The history of sovereign defaults suggests ballooning country debt is an ingredient, but one of many variables contributing to the cause. Japan, for example, has experienced over a decade of debt/GDP levels above 200% without a default.

Finally, country debt is generally a slow‐moving variable. Market participants can have well‐ formed expectations about future debt levels and effects on publicly traded securities, expectations that should be reflected in current market prices. Therefore, it is ultimately an empirical question whether market returns are strongly correlated with country debt. The takeaway here is that a relatively high debt/GDP ratio should not alone deter investors from holding that country’s equities.

In both developed and emerging markets, the results suggest that changes in debt/GDP contain little information about contemporaneous premium returns. On average, even large increases in debt/GDP have not impaired equity markets.

The lack of relation between country debt and stock market returns could signify that debt affects drivers of stock returns in ways that ultimately offset one another. It should also be interpreted as further evidence of the forward‐ looking nature of markets. Whether it be debt, economic growth, inflation, or interest rates, we believe market prices quickly incorporate information and expectations.

“On average, even large increases in debt/GDP have not impaired equity markets.”

Recently, Apple released a software update that includes a much overdue “Legacy Contact” setting. The new tool allows you to specify who can access your Apple account—your photos, notes, email, and more—when you pass away. Apple’s new feature (which can be utilized by any iPhone holder with up‐to‐date software) begs the question—what sorts of things should we be doing now to make our loved ones’ lives easier after we’re gone?

For one, we should all be very interested in what happens to our digital “stuff” after we pass. This isn’t just about making it easier for your family to access some PDFs or to find the safe deposit box or Grandma’s heirlooms. It’s about making sure your online accounts, photos, videos, digital assets, and more are passed to the next generation.

Many people don’t consider this endeavor until it’s too late, leaving their heirs to sort through a mess of files and attempt to access the digital accounts of their loved ones.

What things can I do today that are both easy and impactful?

First, any exercise described herein should be incorporated into your overall estate plan and discussed with your loved ones, financial advisors, and estate planning attorneys.

A basic estate plan should include accurate beneficiary designations, wills, trusts(if needed), powers of attorney, advance medical directives, and other items as relevant to your situation.

Beneficiary designations typically apply to retirement accounts, insurance policies, and annuities. Additionally, many financial companies will allow you to name beneficiaries on non‐retirement accounts, which are often referred to as TOD (transfer on death) or POD

(payable on death) accounts. All beneficiary designations should be reviewed at least annually, or after any major life event (divorce, birth of a child, marriage, etc.).

Once the critical items in your estate plan are drafted and executed, consider creating a document or file that contains any relevant information as well as a roster of important professionals and players in your life (and their contact information) who would be able to assist your heirs with administrative items after your passing.

For example, you might say something along the lines of, “The original copies of our estate planning documents are kept in the fire box in the closet of the master bedroom. The key to open the box is kept in Dad’s lower right desk drawer. One of your first calls should be to {person} at {company}, as they oversee the bulk of our investment assets and helped us create our comprehensive financial plan. They will be able to point you to our estate planning attorney and insurance agent(s).”

You may also consider adding trusted contacts or legacy contacts to certain financial assets, electronic devices, or social media accounts.

OK, but what exactly is a trusted/legacy contact?

A trusted contact is typically someone a custodian or bank can reach out to in the event they are concerned about your health, well‐ being, or welfare (exploitation, endangerment, or neglect). To add a trusted contact, you typically need to know their phone number and physical address. An email address is helpful, but not required. Most institutions also ask for the person’s relationship to you.

These individuals may be asked to share or validate information about you and/or your account(s), such as whether another person or entity has legal authority to act on your behalf or helps with decision‐making rights (e.g., is a holder of power of attorney, legal guardian or conservator, executor, or trustee). With Apple’s new feature for iPhone, a digital legacy contact would be able to access most of what’s in your iCloud account: photos, messages, email, notes, files, contacts, calendars, downloaded apps, and device backups. It’s also important to note what is not included: i.e., passwords stored in your iCloud keychain; licensed media such as audio books, music, or movies you may have purchased.

Whom should I pick as my legacy/trusted contact?

This is arguably the most difficult question. The person you name as your will’s executor might not be the same person you want accessing your social media accounts or Apple devices. You must consider who you want to have access to your data, when the universe of data is growing exponentially. Most estate planners suggest identifying someone who is trustworthy as well as tech‐savvy enough to deal with these items, and you should always discuss decisions like these with your family and team of trusted advisors.

John, a New Hope, Pennsylvania native, is the Founder and CEO of Rockwood Wealth Management. A former nuclear engineer, he is committed to the development and growth of conflict-free comprehensive financial planning and investment management. John values a client-centric practice and unwavering integrity in all of our endeavors as stewards of our clients' best interests.