That’s quite sage counsel by market pioneer David Booth, an American businessman, investor, and philanthropist—after whom The University of Chicago Booth School of Business is named. His words remind us that you don’t have to change your investment strategy based on the presidential election outcome. That’s one of the great perks for you, given that you are a Rockwood client and long-term investor who keeps score in decades and not days.

The anticipation building up to elections often brings with it emotion and anxiety about how financial markets will respond. While the outcome is unknown, one thing is for certain: There will be a steady stream of opinions from prognosticators, pundits, perhaps your least favorite neighbor, Larry from accounts receivable, and maybe your aunt—the armchair economist—about how the election will impact the stock market. As we explain below and derive empirically, investors would be well served to avoid the temptation to make changes to a long-term investment plan based on this cacophony of noise.

To be certain, the outcome of an election is only one of many inputs to the market. The exhibits that follow examine market and economic data for nearly 100 years of US presidential terms and show a consistent upward march for US equities regardless of the administration in place. This is an important lesson on the benefits of a long-term investment approach.

Short-Term Market Movements and Presidential Election Results

You already know that trying to outguess the market is often a losing game. Current market prices offer an up-to-the-minute snapshot of the aggregate expectations of market participants. In times of uncertainty, it’s important to remember that markets deal exceptionally well with new information. This includes the collective expectations about the outcome and impact of elections.

While unanticipated future events—surprises relative to those expectations—may trigger price changes in the future, the nature of these surprises cannot be known by investors today. As a result, it is difficult—if not impossible—to gain an edge by attempting to predict what will happen to the stock market after a presidential election.

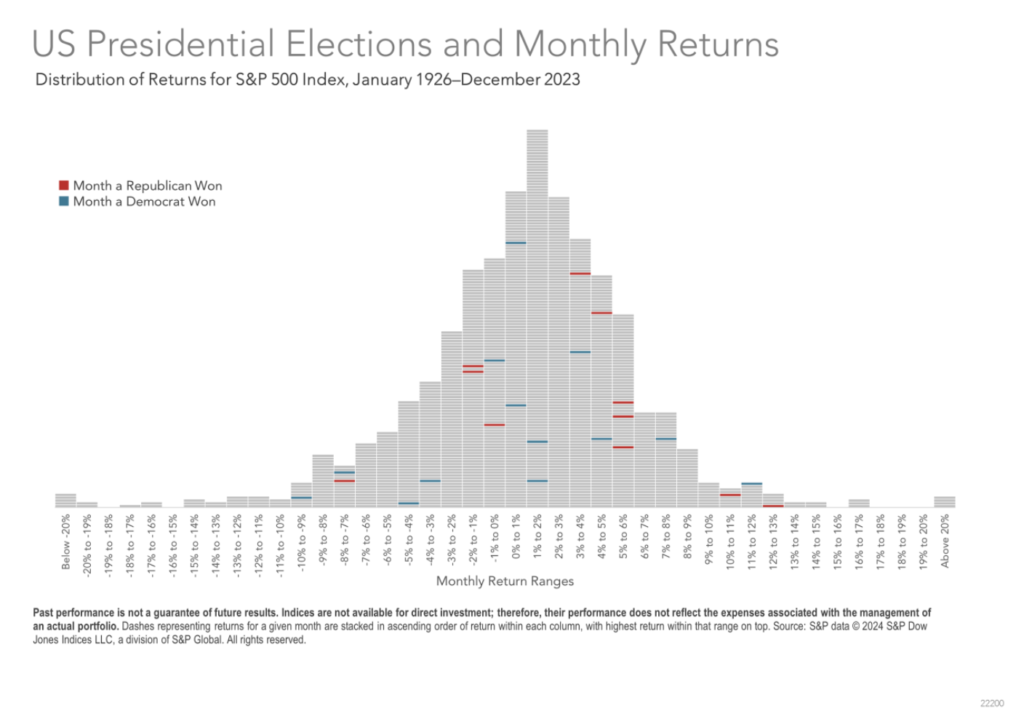

Let’s back up this assertion with data. On the following page, the graphic shows the frequency of monthly returns (expressed in 1% increments) for large-cap US stocks from January 1926 to December 2023. Each horizontal dash represents one month, and each vertical bar shows the cumulative number of months for which returns were within a given 1% range (e.g., the tallest bar shows all months where returns were between 1% and 2%). The blue and red horizontal lines represent months during which a presidential election was held. Red corresponds with a resulting win for the Republican Party and blue with a win for the Democratic Party. This graphic illustrates that election month returns were well within the typical range of returns, regardless of which party won the election—therefore, no advantage can be gleaned by trading around the election.

Long-Term Investing: Bulls & Bears ≠ Donkeys & Elephants

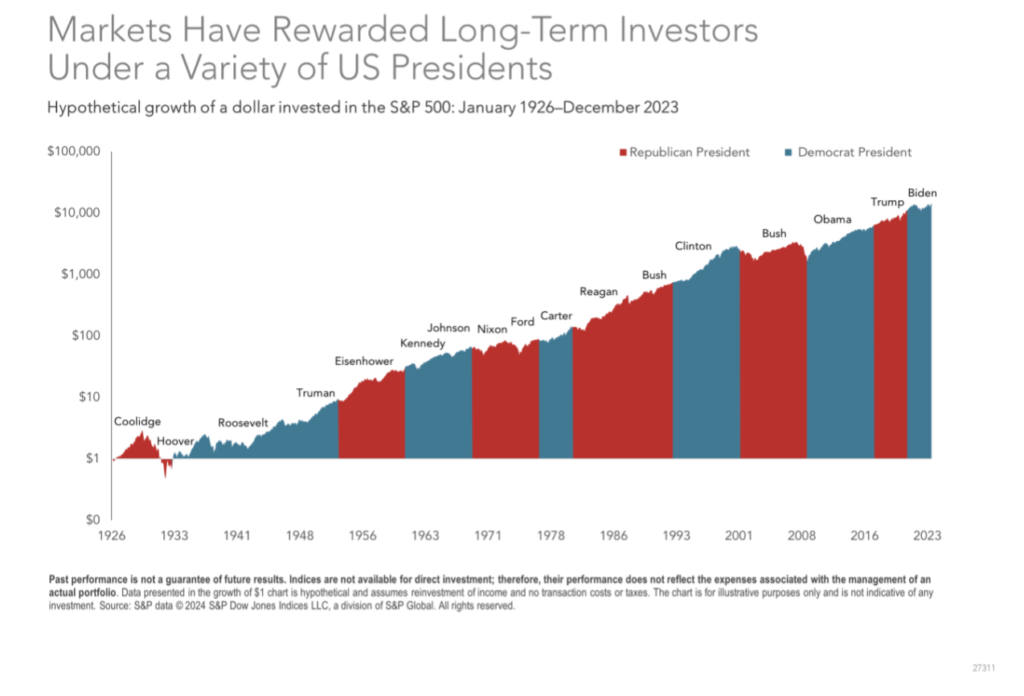

Predictions about presidential elections and the stock market often focus on which party or candidate will be “better for the market” over the long run. The exhibit on the following page shows the growth of one dollar invested in large-cap US stocks over nine decades and 17 presidencies (from Coolidge to Biden). This data shows there is no discernable pattern of long-term stock market performance based on which party holds the Oval Office. The key takeaway here is that over the long run, the market has provided substantial returns regardless of who controlled the executive branch or where we were in the election cycle.

What is the basis of this unwavering confidence? It’s rooted in 98 years of data on stock returns (all the way back to President Calvin Coolidge) that shows unerringly that capturing the long-term returns of the capital markets has not depended on which party controls the White House.

Now we are not saying Coolidge, Hoover, Roosevelt, Truman, Eisenhower, Kennedy, Johnson, Nixon, Ford, Carter, Reagan, Bush, Clinton, Bush II, Obama, Trump, and Biden didn’t each impact the economy and markets in their own ways. Historians will argue about how and how much. But when we examine data, there is no evidence that would point to an investment choice you should make based on which party wins.

Equity markets can help investors grow their assets, but investing is a long-term endeavor. Trying to make investment decisions based on the outcome of presidential elections is unlikely to result in reliable excess returns for investors. At best, any positive outcome based on such a strategy will likely be the result of random luck. At worst, it can lead to costly mistakes.

When we step back from the rhetoric and the emotion, it seems obvious that the president doesn’t sit in the Oval Office and run the economy. Four to eight years is a short period of time when it comes to investing. What really counts long term is American ingenuity—products and services that solve problems.

We want you to remember that the US market isn’t a reflection of who’s temporarily president, but of the ingenuity of the American people. Over decades, it’s American innovation that succeeds, no matter what politicians do. We know how to invest going forward—no matter who the president is.

John, a New Hope, Pennsylvania native, is the Founder and CEO of Rockwood Wealth Management. A former nuclear engineer, he is committed to the development and growth of conflict-free comprehensive financial planning and investment management. John values a client-centric practice and unwavering integrity in all of our endeavors as stewards of our clients' best interests.