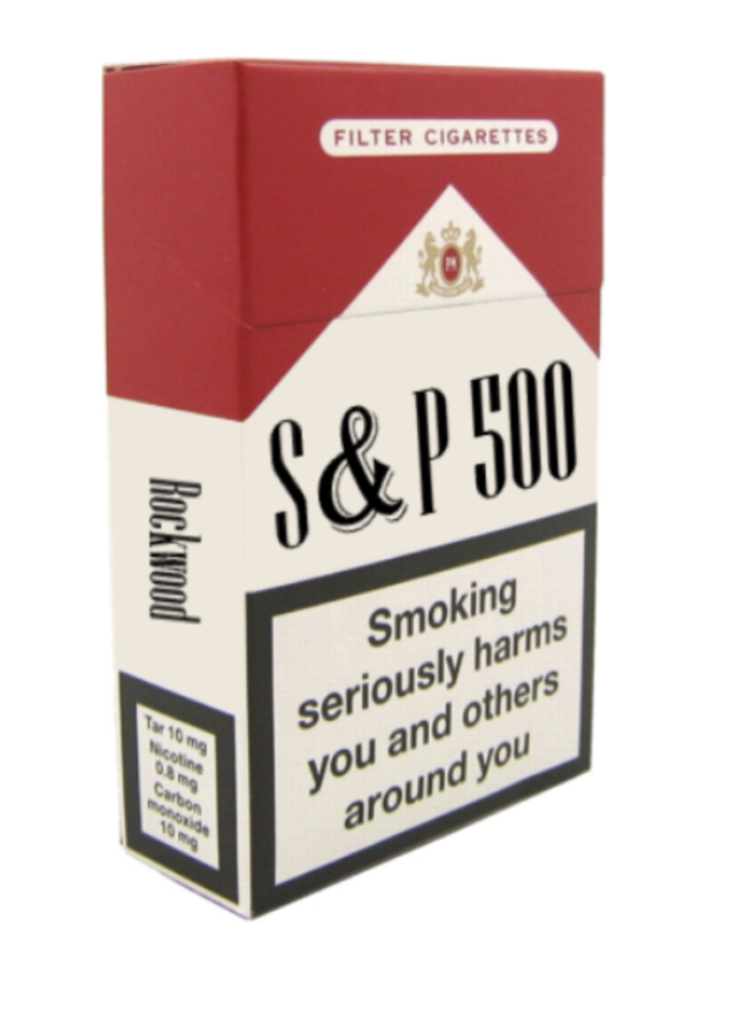

If the surgeon general were an investment expert, he or she would not waste any time slapping a warning label on today’s S&P 500. Concentration in major equity market indices is at a 50-year high. The top five companies in the S&P 500 comprise approximately 30% of the index … yikes! This figure is more than double the 14% average since 1990. Further compounding the issue is that the five stocks — Apple, Nvidia, Microsoft, Amazon, and Google — are all technology stocks, meaning that they are highly correlated with one another.

Many investors choose an index fund like the S&P 500 in hopes of achieving diversified exposure to a particular segment of the market. However, it is certain that the majority of investors are unaware of the concentration risk that recently has been embedded in many major market indices.

If an investor owns the S&P 500 today, they are effectively asserting that “I am choosing to put 30% of my money in five highly correlated technology stocks, and then I’ll attempt to more responsibly invest the other 70% in the S&P 495.” Of course, there is no such thing as the S&P 495 — we just made that up for effect. But we are sure you get the point we are making — owning the S&P 500 as an investment strategy is fraught with risk that many investors won’t see coming.

Incidentally, we have no issue at all with the S&P 500 as used in its role as a commercial benchmark for market cap-weighted large-cap US stocks. It just shouldn’t be mistaken for a prudent investment strategy. Commercial benchmark? Just fine. Preferred strategy for portfolio implementation? Not so much.

Impact on Portfolios

Such intense concentration in market indices can have equally hidden and profound effects on many unsuspecting investors’ portfolios. The issue silently simmering is that a handful of mega-cap stocks drive the majority of returns for the indices. The issue is compounded by the notion that many of these stocks are in the information technology sector.

At the time of writing, technology stocks account for 33% of the S&P 500 Index and 60% of the Russell 1000 Growth Index. Therefore, an index like the S&P 500 now acts more like the information technology sector than it did a decade ago when the sector was less than 13% of the index, and certainly more than in 1990 when the sector had just a 6% weighting.

It isn’t just sector concentration that may lead to changes in return characteristics but factor exposures as well. Many of the mega-cap stocks, such as Nvidia, Amazon, and Microsoft, are more growth oriented and can have negative correlations with interest rates. These factors are in stark contrast to other stocks such as ExxonMobil or General Motors (two companies that have been in the top five of the S&P 500 many times in the past), which have typically positive correlations with rates. This dynamic may be one of the drivers behind the increasing correlation of the S&P 500 and the US bond market in recent years — which, of course, can lead to increased portfolio volatility.

The silver lining for well-advised investors is that the faster pace of change these days and shorter competitive advantage periods may make room for new companies to ascend to the top of the charts. If change is accelerating, it may make new and smaller companies that are destined to become the leaders of tomorrow even more attractive. Of note, these small- and mid-cap companies are historically inexpensive on a price-to-earnings basis relative to large-cap stocks. Importantly, you already own them all and you don’t need to pick the winners to participate in the ascendence of smaller stocks when it arrives.

The moral of the story is accepting index weighting as it happens to appear and mistaking it for a sound investment strategy is going to end poorly for many investors who simply don’t understand what they own. We’re sure the surgeon general would agree.

Source: Alger 2025, Standard & Poor’s, Vanguard.

John, a New Hope, Pennsylvania native, is the Founder and CEO of Rockwood Wealth Management. A former nuclear engineer, he is committed to the development and growth of conflict-free comprehensive financial planning and investment management. John values a client-centric practice and unwavering integrity in all of our endeavors as stewards of our clients' best interests.