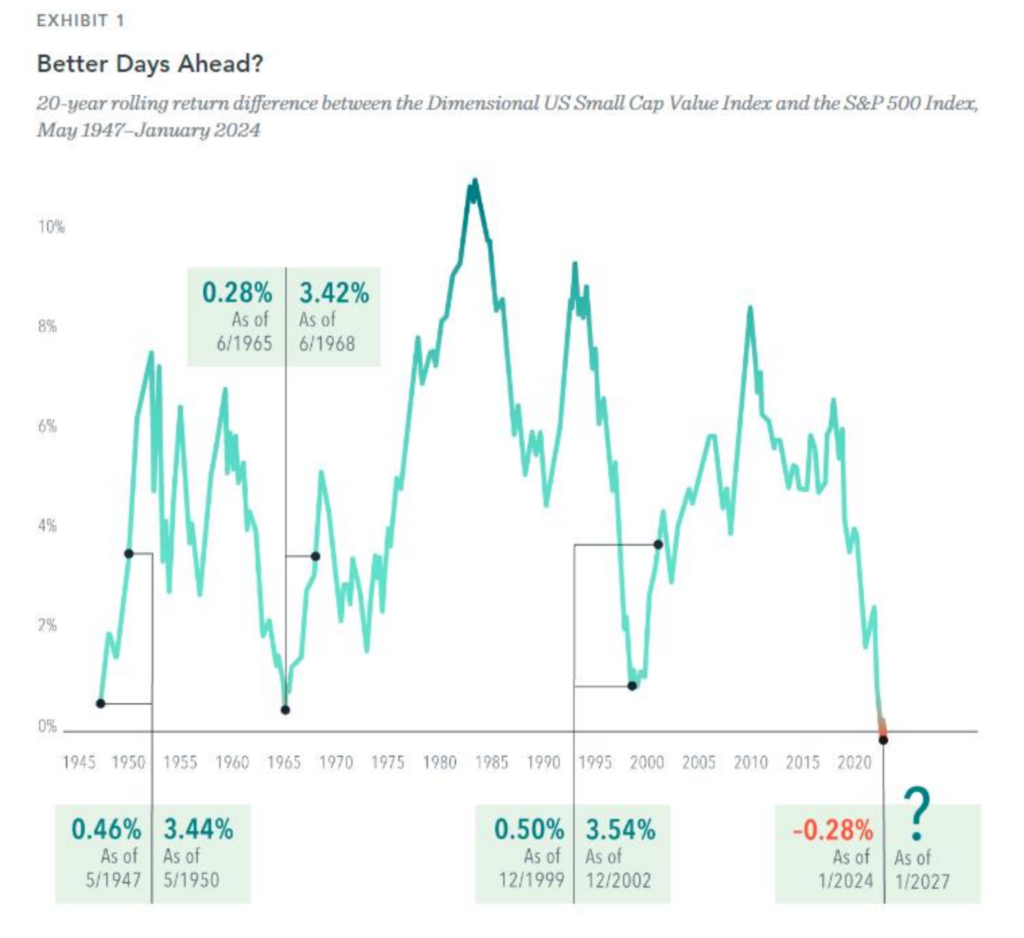

The 20-year relative return of US small cap value stocks versus the S&P 500 Index dipped negative recently for the first time in US stock market history. Two decades is a long time for an expected premium not to show up. Outliers on the negative side are never pleasant, but we can look to other previous outliers for some encouragement.

Many in the industry will recall the disappointing stretch at the end of the 1990s when US small cap value’s trailing 20-year return was statistically indistinguishable from the S&P 500’s. Less familiar might be the periods in 1947 and 1965 when the trailing 20-year premium was similarly flat.

In all three cases, small value staged a rapid turnaround. We can see this by measuring each of the trailing 20-year return spreads again three years later. For example, we compare the observation on December 31, 1999, with the trailing 20-year return difference as of December 31, 2002. In all three previous cases, small cap value’s advantage jumped to more than three percentage points annualized.

No one can say whether we’ll get a similar turnaround this time. But history suggests giving up on small cap value after its worst stretches would have been a mistake. Past performance doesn’t upend the logic of expecting a higher return for stocks with low prices relative to their book equity. And for any remaining skeptics, it’s worth noting that small value’s struggles in the United States have not been shared by developed ex-US or emerging markets, where small cap value stocks have outperformed their large cap counterparts by 2.7% and 4.0%, respectively, over the past 20 years.

John, a New Hope, Pennsylvania native, is the Founder and CEO of Rockwood Wealth Management. A former nuclear engineer, he is committed to the development and growth of conflict-free comprehensive financial planning and investment management. John values a client-centric practice and unwavering integrity in all of our endeavors as stewards of our clients' best interests.