by John R. Augenblick | Jan 1, 2023 | Quarterly Perspective

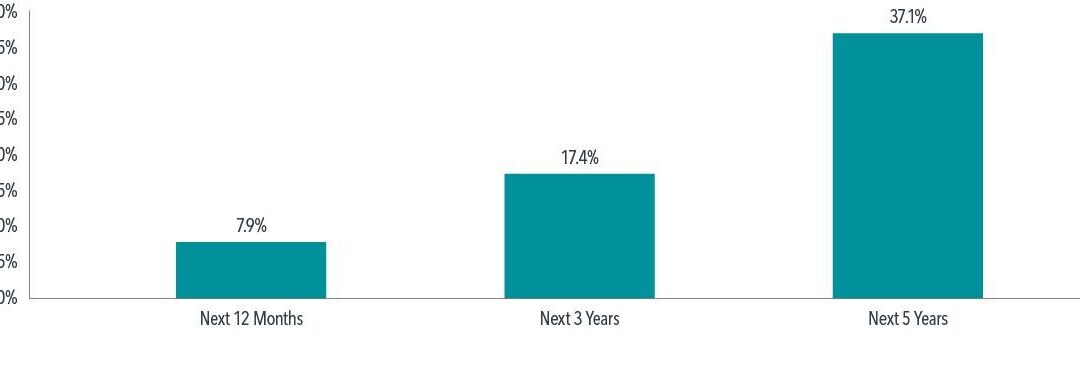

The past 3 years were a good test for the prudence of your investment plan. Think back to December 2019. The economy was humming. Unemployment, interest rates, and inflation were at historically low levels. But then what happened? A global pandemic hit. The S&P...

by John R. Augenblick | Dec 1, 2022 | Quarterly Perspective

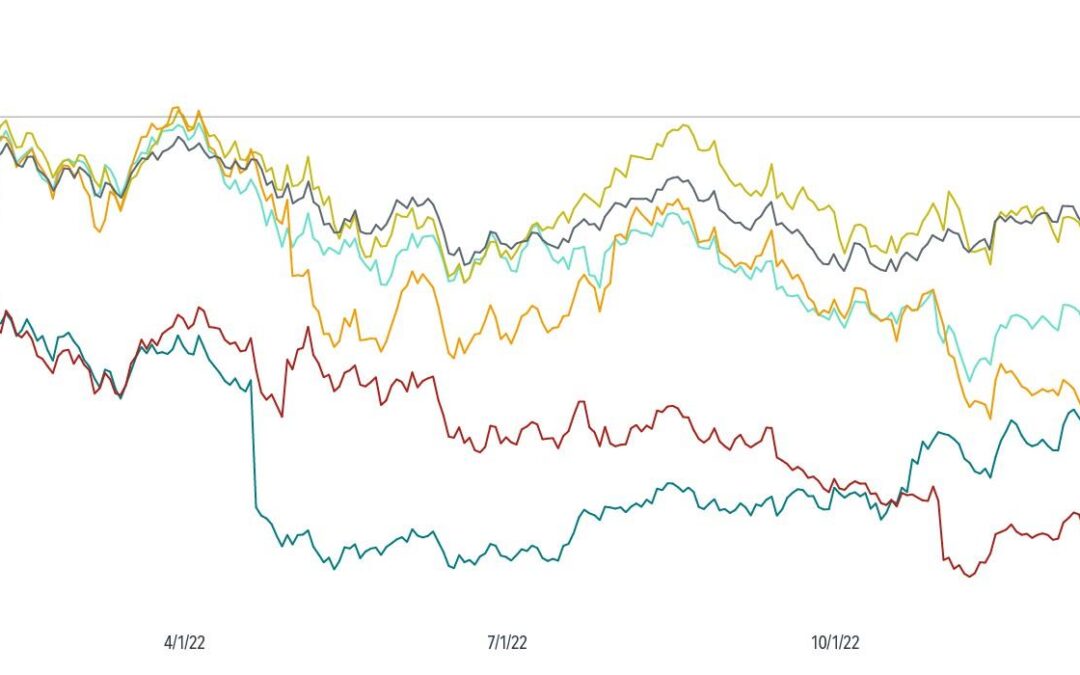

Last time investors saw back-to-back losses was late 1950s Some may view fixed income as a safe haven for investors, expecting bonds to rise in value when stocks fall. However, this was not the case in 2022. The tandem decline for equities and fixed income was...

by John R. Augenblick | Dec 1, 2022 | Quarterly Perspective

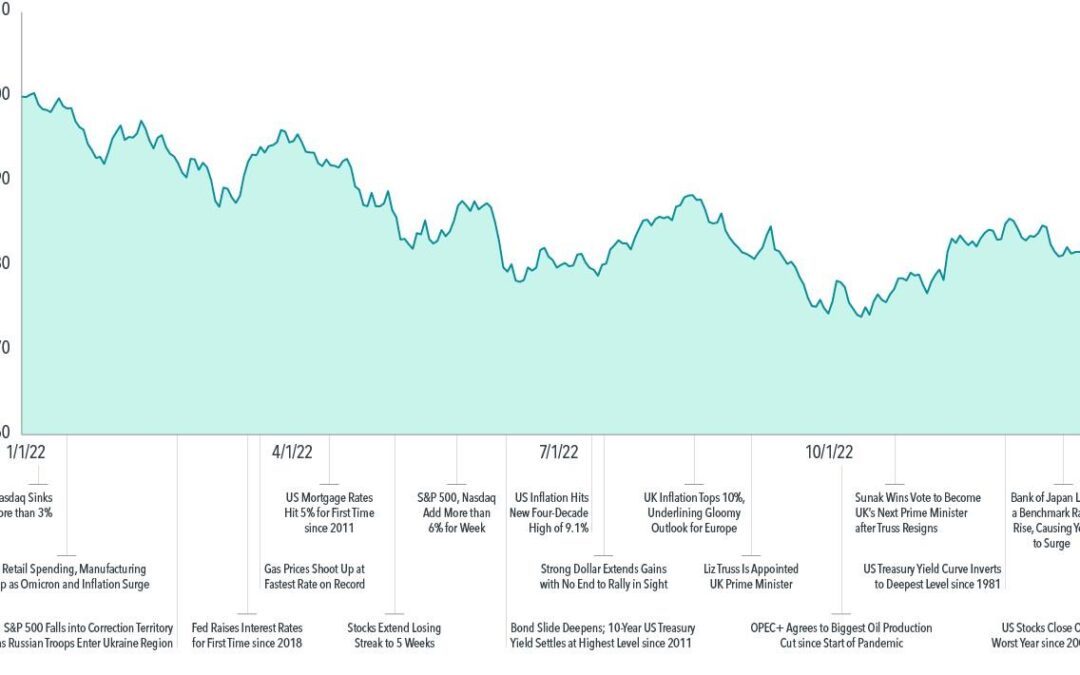

Looking to the Past as a Guide It was an up-and-down year for markets—in the end, one with more down than up. The world gave financial markets a lot to process. The coronavirus pandemic eased but remained a global concern, as did the supply-chain issues that...

by John R. Augenblick | Dec 1, 2022 | Quarterly Perspective

The 60/40 portfolio had a hard time offering much support. With both fixed income and equities declining on the year, the traditional 60% stock/40% bond portfolio had a hard time offering much support in either asset category, leading some to question the utility of...

by John R. Augenblick | Dec 1, 2022 | Quarterly Perspective

Cryptocurrencies and FAANG stocks were all hit hard. If the market decline of 2022 taught investors anything, it’s that what goes up might also come down. Some of the most hyped investments of the past two years did just that. Cryptocurrencies[8] and FAANG stocks[9]...

by John R. Augenblick | Oct 1, 2022 | Quarterly Perspective

What is the annual gift tax exclusion? We all know the expression that there are only two certainties in life: death and taxes. We just don’t always think about the collision of these two forces at the worst possible time if we neglect strategic lifetime tax planning....

Recent Comments